April 6, 2018

Categories: Financial Education, Home Buyer Education, Homeownership, Housing Counseling

To recognize April as National Financial Literacy month, our blog entries this month will highlight the importance of financial literacy, raise awareness about challenges homeowners face, and emphasize how individuals can establish and maintain healthy financial habits.

Earlier this year, TSAHC partnered with HOPE NOW Alliance to conduct a joint survey on financial hardships in Texas. Our shared goal was to better understand the hardships facing Texas homeowners, particularly in the aftermath of Hurricane Harvey. In early January, we sent the survey to our network of lenders and REALTORS®.

The complete survey results can be found here. We hope these results will help housing industry professionals better understand the challenges homeowners face and how to respond to their needs. Here at TSAHC, we are using the results to improve our outreach efforts and partnerships with lenders, REALTORS® and housing counselors.

Below are highlights from the survey results that we believe stand out the most.

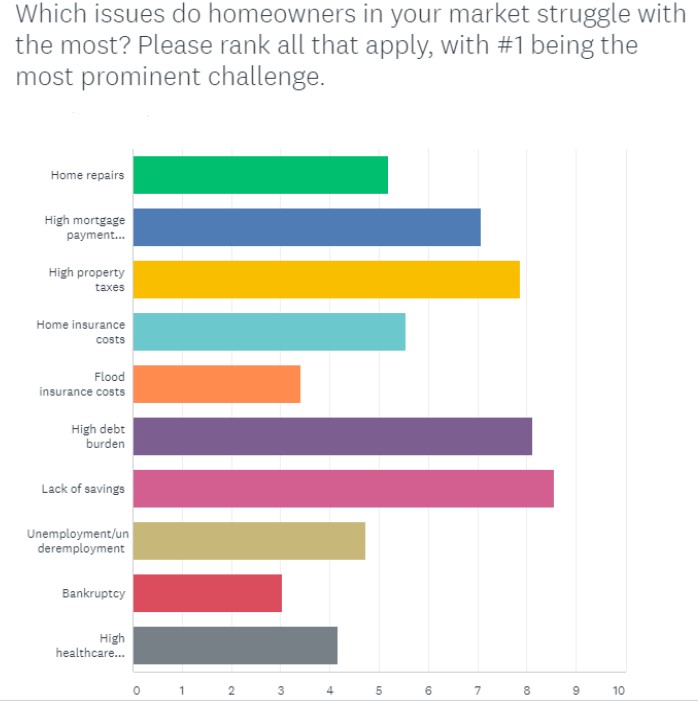

First, financial security is the biggest challenge for homeowners as lack of savings and high debt burden are the top two issues they face.

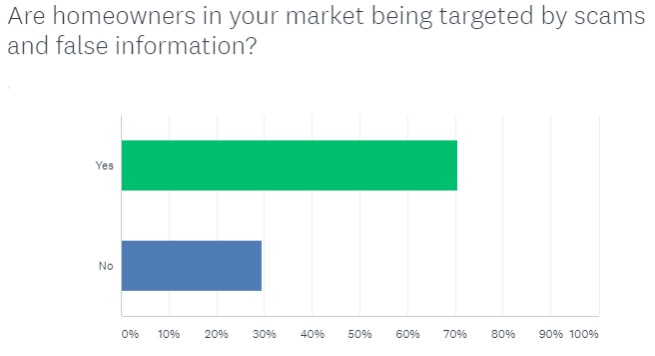

Second, a significant majority of respondents said homeowners are being targeted by scams and false information. This is of particular concern to households recovering from a natural disaster like Hurricane Harvey, a circumstance that may make them more vulnerable to suspicious activities.

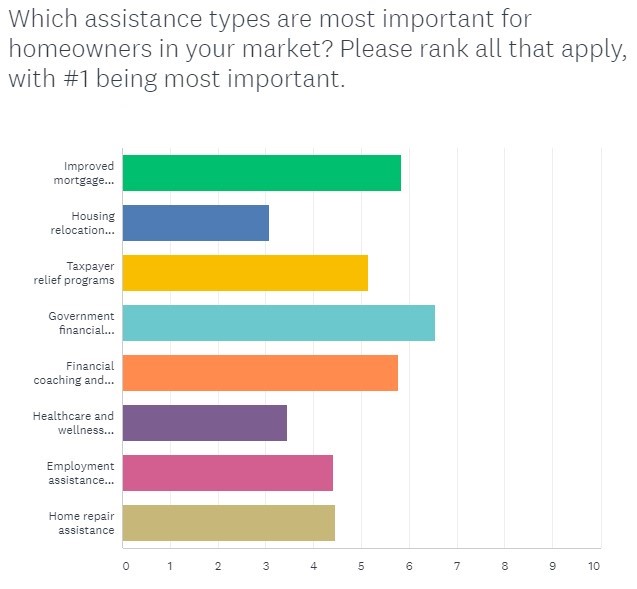

Lastly, government assistance ranks as the most important type of assistance for homeowners with more than 68 percent of respondents ranking it in the top two. Improved mortgage company engagement with struggling borrowers and financial coaching and education were nearly tied for the second most important type of assistance.

Please spread the word about these survey results and the common challenges facing Texas borrowers. We also encourage homeowners facing financial difficulties to visit TSAHC’s Texas Financial Toolbox, where they can find a housing counselor to help them improve their credit, pay down debt and/or avoid mortgage delinquency and foreclosure.

On the House blog posts are meant to provide general information on various housing-related issues, research and programs. We are not liable for any errors or inaccuracies in the information provided by blog sources. Furthermore, this blog is not legal advice and should not be used as a substitute for legal advice from a licensed professional attorney.

TSAHC reviews all blog comments before they are posted to ensure a positive experience for our online community. Off-topic comments; hostile, derogatory or deliberately insulting comments; and comments specifically promoting goods and services will not be posted.

Approved comments will be published in their entirety. Personal information will not be removed unless it pertains to someone other than the person submitting the comment. For more information, please see our Comment Posting Guidelines.

To remove a previously submitted and published comment, please contact Anna Orendain at [email protected].

If you have a question regarding any of TSAHC's programs, please contact us.