July 17, 2015 | by Katie Claflin

Categories: Affordable Housing, Rental Housing

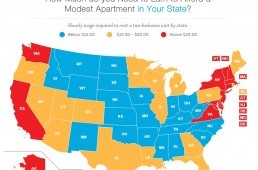

In May 2015 the National Low Income Housing Coalition released its annual Out of Reach report, which calculates the hourly wage a household needs to earn to afford a modest market rate apartment.

The 2015 report finds that the hourly wage needed to afford a two bedroom apartment is $19.35/hour, which is more than 2.5 times the current minimum wage.

While housing prices in Texas fare slightly better than the national average, the report's findings for Texas are still concerning. Working 40 hours a week, in Texas you still need to earn $16.62/hour to be able to afford a modest two bedroom apartment (which costs about $864/month).

In order to afford the rising cost of rent, Texas families earning less than $16.62/hour often have to do at least one of the following:

The report’s findings clearly indicate the ongoing need for affordable housing both in Texas and throughout the United States. In the words of Oregon Governor Kate Brown, who wrote the Preface to the 2015 Out of Reach report, “There simply isn’t enough reasonably priced, decently maintained housing to meet the demand.”

Coming Soon: Texas Housing Impact Fund

To fulfill our mission to serve the housing needs of low-income Texans, TSAHC offers several financing options to help developers create rental housing that is affordable for Texas families and individuals. These include tax-exempt bonds for larger affordable housing projects, as well as loan products for short and long-term financing.

In an effort to expand our programs and create more housing, TSAHC also plans to rebrand our loan products as the Texas Housing Impact Fund, which will help us better communicate their purpose both to developers and potential investors. Click here to read more about the types of financing we provide and the draft policies for the Texas Housing Impact Fund. We'll make sure to keep you posted when the policies are finalized and the new Texas Housing Impact Fund is formally announced.

On the House blog posts are meant to provide general information on various housing-related issues, research and programs. We are not liable for any errors or inaccuracies in the information provided by blog sources. Furthermore, this blog is not legal advice and should not be used as a substitute for legal advice from a licensed professional attorney.

TSAHC reviews all blog comments before they are posted to ensure a positive experience for our online community. Off-topic comments; hostile, derogatory or deliberately insulting comments; and comments specifically promoting goods and services will not be posted.

Approved comments will be published in their entirety. Personal information will not be removed unless it pertains to someone other than the person submitting the comment. For more information, please see our Comment Posting Guidelines.

To remove a previously submitted and published comment, please contact Anna Orendain at [email protected].

If you have a question regarding any of TSAHC's programs, please contact us.

Absolutely agree that rentals are going up higher. I find rentals are going up 15% more than last year. Because of higher property prices apartments are going all out with increases. Salaries are not adjusting to cope . Homeownership is still the path to go as there are downpayment assistance programs that can help. Paying a mortgage helps build equity for young adults who will eventually have children. Equity in homes can help with their education/college. According to the National Association of Realtors if you own a home 60% of your net worth is equity from your home but if you never own a home your equity shrunk by 60% !