May 3, 2019 | by Michael Wilt

Categories: Affordable Housing, Construction, Rental Housing

This post was originally published on January 13, 2017.

A frequent question about affordable housing is who pays for it and how. A common assumption is that taxpayers foot the bill for the construction of affordable rental housing or rents for residents that live there. In reality, that's not always true.

In this entry, we will look at some of the common ways affordable housing is paid for and specifically the role subsidies play to help provide clarity.

Low-Income Housing Tax Credit Program

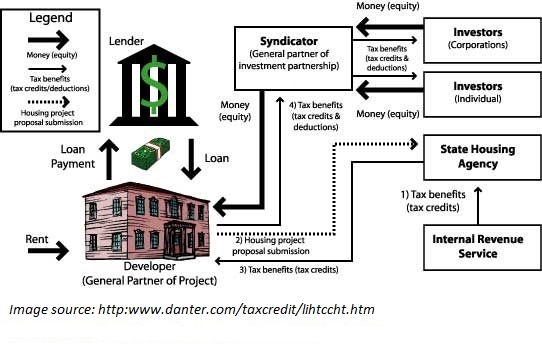

Created by the Tax Reform Act of 1986, the Low-Income Housing Tax Credit (LIHTC) program is the most utilized mechanism for financing affordable housing development. It works by letting private investors (corporations or individuals) purchase tax credits that reduce their tax liability. The money they use to purchase tax credits provides equity to developers to build and preserve affordable housing.

In Texas, the Texas Department of Housing and Community Affairs (TDHCA) administers the process for awarding tax credits to developers. TDHCA is responsible for ensuring that developers provide the housing they promised when applying for tax credits.

Developers combine the tax credit equity with other sources of funding like a loan from a bank or tax-exempt housing bonds (explained below) to finance all of the development costs. You can reference the flow chart in the image above to better understand how the program and funding work.

Multifamily Tax-Exempt Housing Bonds

Another popular source of funding for affordable housing development is through multifamily tax-exempt housing bonds. TSAHC has the authority to issue these bonds to finance the construction and preservation of multifamily housing that meets one of our four targeted housing needs.

These bonds are purchased by private investors but unlike bonds approved by voters in local elections for building schools or other public facilities, these bonds are not a debt to a government entity on the local, state or federal level. And, just like the LIHTC program, this is a private source of investment in affordable housing.

Housing Choice Vouchers

Established under Section 8 of the Housing Act of 1937, this federal rental assistance program provides housing vouchers to very low-income households. TDHCA administers the program in Texas along with local public housing authorities.

There are two types of vouchers. Tenant-based vouchers allow tenants to rent from a private owner that accepts vouchers. Project-based vouchers are for developments where some or all of the units are reserved for very low-income residents. Vouchers pay the balance of a rent payment that exceeds 30% of a renter’s monthly income. So, while vouchers do reduce the rent recipients pay, recipients still pay a portion of the rent.

The program is federally funded through the U.S. Department of Housing and Urban Development's budget. So, in this instance, it is a taxpayer subsidy that pays for the recipient's housing voucher.

By no means is this a complete list of funding sources for affordable housing. There are other sources, such as loans or grants from financial institutions, corporations or foundations. Depending on the location or type of development, sources may also include the use of local taxpayer funds, such as funding from a local housing trust fund. However, the explanations above should help clarify the role taxpayer funds and private funds play in building and providing affordable housing.

On the House blog posts are meant to provide general information on various housing-related issues, research and programs. We are not liable for any errors or inaccuracies in the information provided by blog sources. Furthermore, this blog is not legal advice and should not be used as a substitute for legal advice from a licensed professional attorney.

TSAHC reviews all blog comments before they are posted to ensure a positive experience for our online community. Off-topic comments; hostile, derogatory or deliberately insulting comments; and comments specifically promoting goods and services will not be posted.

Approved comments will be published in their entirety. Personal information will not be removed unless it pertains to someone other than the person submitting the comment. For more information, please see our Comment Posting Guidelines.

To remove a previously submitted and published comment, please contact Anna Orendain at [email protected].

If you have a question regarding any of TSAHC's programs, please contact us.